# A tibble: 1,105 × 6

refdate cur_days biz_days forward_date r_252 r_360

<date> <int> <dbl> <date> <dbl> <dbl>

1 2020-03-19 1 1 2020-03-20 0.0365 0

2 2020-03-19 4 2 2020-03-23 0.0365 0.0259

3 2020-03-19 7 5 2020-03-26 0.0365 0.0372

4 2020-03-19 11 7 2020-03-30 0.0365 0.0331

5 2020-03-19 12 8 2020-03-31 0.0365 0.0347

6 2020-03-19 13 9 2020-04-01 0.0365 0.036

7 2020-03-19 14 10 2020-04-02 0.0365 0.0372

8 2020-03-19 21 15 2020-04-09 0.0365 0.0372

9 2020-03-19 27 18 2020-04-15 0.0365 0.0347

10 2020-03-19 32 21 2020-04-20 0.0365 0.0342

# ℹ 1,095 more rowsrb3

Wilson Freitas

Agenda

- Missão

- Um pouco de história

- O que o 📦

{rb3}tem? - Aplicações

Missão

Prover acesso estruturado a todo conteúdo útil disponível no site da B3.

Um pouco de história

- O

{rb3}nasceu como{rbmfbovespa}com o objetivo de ler os arquivos disponíveis no site da Bolsa. - Esse pacote nunca foi para o CRAN.

- Em abril/2022, Perlin me procurou pra colocar uma função para fazer download da curva de juros da Bolsa (então B3) no pacote

{fixedincome}. - Nasce

{rb3}como continuação do{rbmfbovespa}com o Perlin integrando o projeto. - Em 2023 o projeto foi aceito no rOpenSci

O que o 📦 {rb3} tem?

- Curvas de juros: juros nominais (prefixados), juros reais, cupom cambial

- Preços de ajuste de contratos futuros: DI1, DOL, IND, DAP, …

- Cotações diárias não ajustadas: ações, BDRs, ETFs, FIIs, FIAGROs, …

- Prêmio de opções de ações

- Séries históricas de índices: IBOV, IBXL, IBXX, SMLL, …

- Composição e pesos de ações nos índices

- Segmentos das ações

- Eventos corporativos de empresas: dividendos, subscrição, grupamento, desdobramento, …

- Cache

Curvas de juros

- As curvas de juros estão disponíveis na página Taxas Referenciais da B3

- Histórico começa em 2018

yc_get()yc_ipca_get()yc_usd_get()

yc_mget()yc_ipca_mget()yc_usd_mget()

Curva de juros nominais (prefixados)

library(rb3)

df_yc <- yc_mget(

first_date = Sys.Date() - 255 * 5,

last_date = Sys.Date(),

by = 255

)

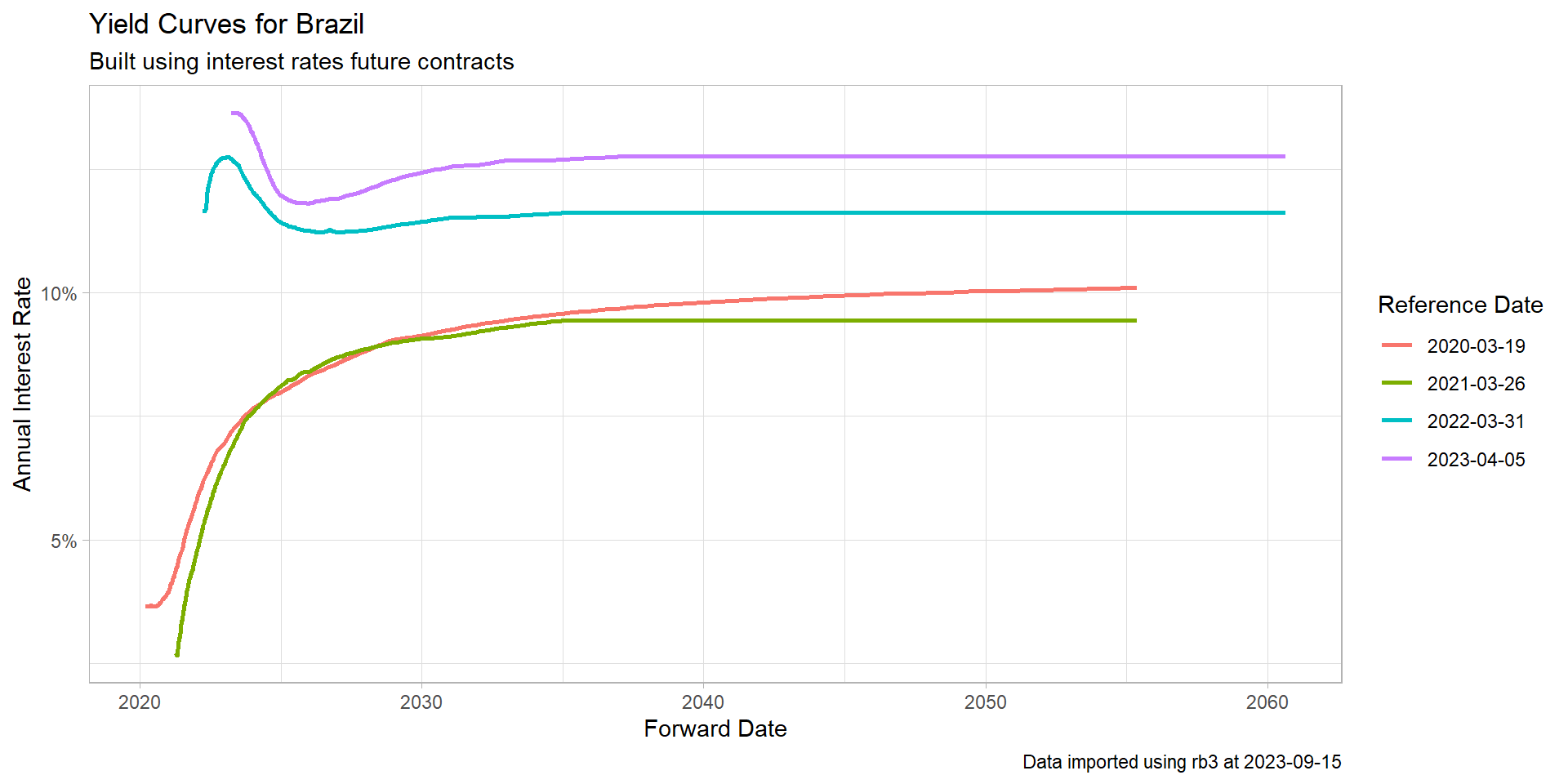

df_ycCurvas de juros nominais (prefixados)

Code

library(tidyverse)

ggplot(

df_yc,

aes(x = forward_date, y = r_252, group = refdate, color = factor(refdate))

) +

geom_line(linewidth = 1) +

labs(

title = "Yield Curves for Brazil",

subtitle = "Built using interest rates future contracts",

caption = str_glue("Data imported using rb3 at {Sys.Date()}"),

x = "Forward Date",

y = "Annual Interest Rate",

color = "Reference Date"

) +

theme_light() +

scale_y_continuous(labels = scales::percent)

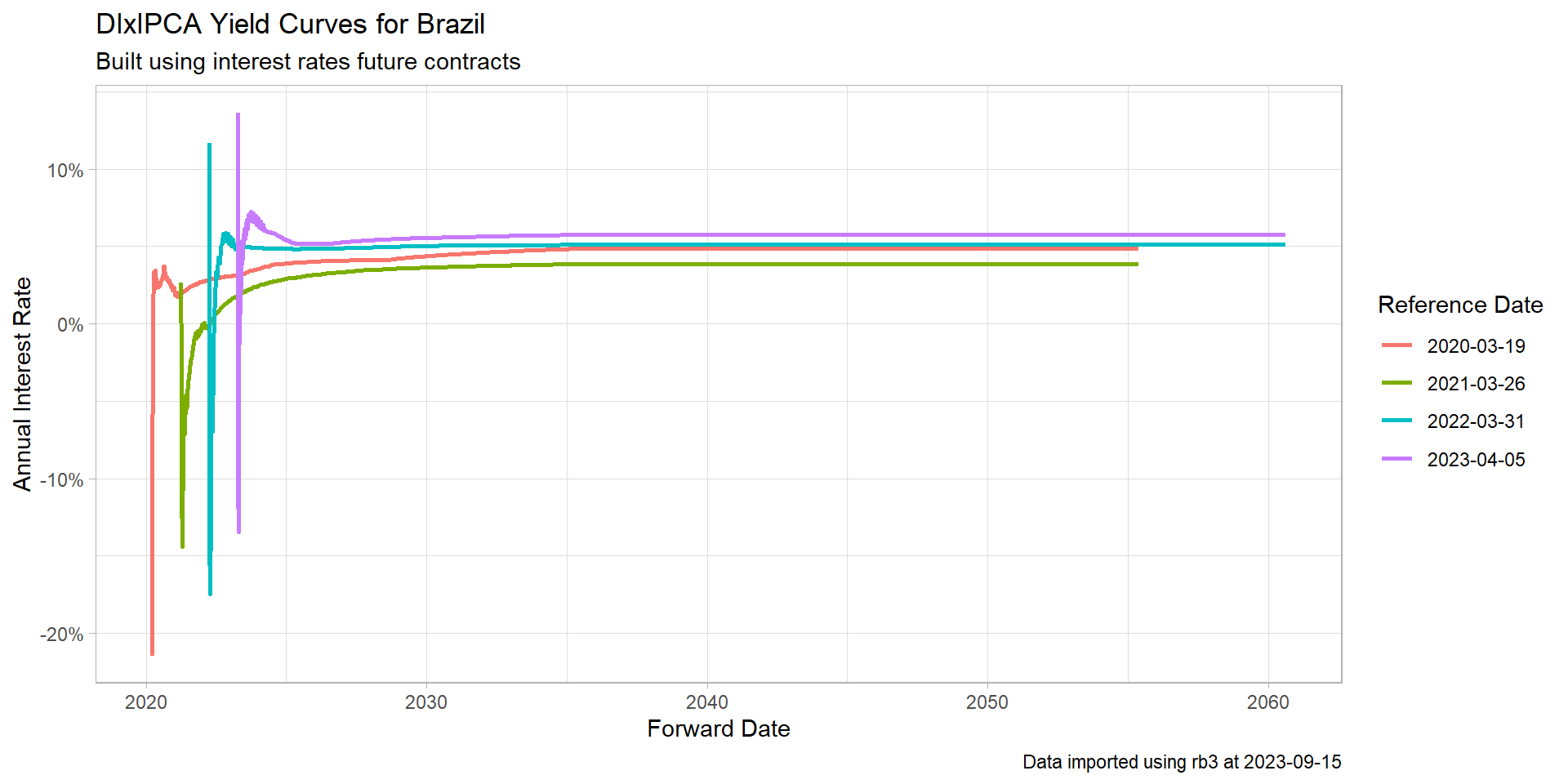

Curva de juros reais (cupom de IPCA)

Code

df_ipca_yc <- yc_ipca_mget(

first_date = Sys.Date() - 255 * 5,

last_date = Sys.Date(),

by = 255

)

ggplot(

df_ipca_yc,

aes(x = forward_date, y = r_252, group = refdate, color = factor(refdate))

) +

geom_line(linewidth = 1) +

labs(

title = "DIxIPCA Yield Curves for Brazil",

subtitle = "Built using interest rates future contracts",

caption = str_glue("Data imported using rb3 at {Sys.Date()}"),

x = "Forward Date",

y = "Annual Interest Rate",

color = "Reference Date"

) +

theme_light() +

scale_y_continuous(labels = scales::percent)

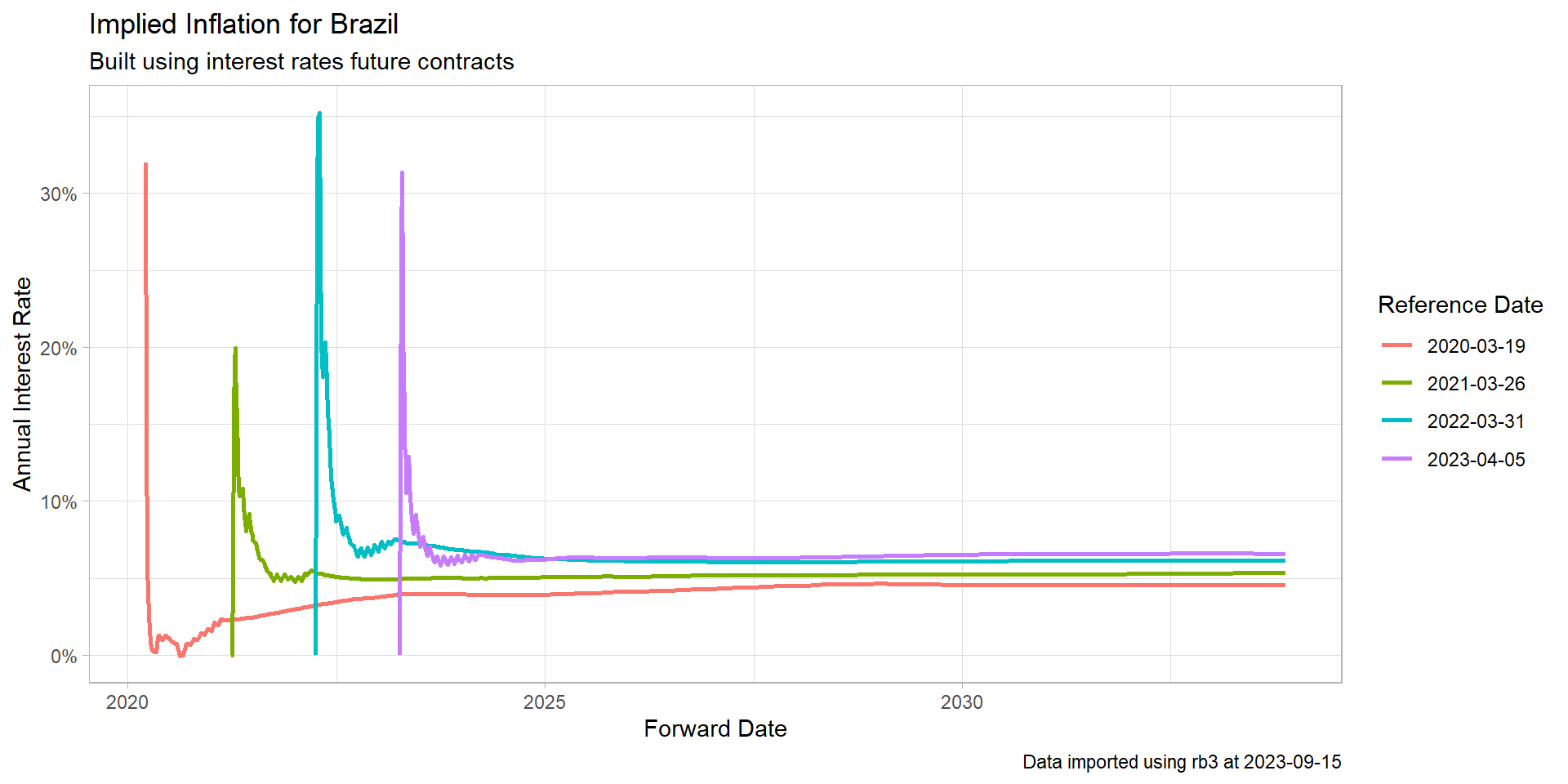

Inflação Implícita

pre_factor <- df_yc |>

mutate(factor_pre = (1 + r_252) ^ (biz_days/252)) |>

select(refdate, forward_date, biz_days, factor_pre)

ipca_factor <- df_ipca_yc |>

mutate(factor_ipca = (1 + r_252) ^ (biz_days/252)) |>

select(refdate, forward_date, biz_days, factor_ipca)

inflation <- pre_factor |>

left_join(ipca_factor,

by = c("refdate", "forward_date", "biz_days")) |>

mutate(

inflation = (factor_pre / factor_ipca) ^ (252 / biz_days) - 1

)Inflação Implícita

Code

ggplot(

inflation |> filter(forward_date < as.Date("2034-01-01")),

aes(

x = forward_date,

y = inflation,

group = refdate,

color = factor(refdate)

)

) +

geom_line(linewidth = 1) +

labs(

title = "Implied Inflation for Brazil",

subtitle = "Built using interest rates future contracts",

caption = str_glue("Data imported using rb3 at {Sys.Date()}"),

x = "Forward Date",

y = "Annual Interest Rate",

color = "Reference Date"

) +

theme_light() +

scale_y_continuous(labels = scales::percent)

Contratos Futuros

- Os preços de ajuste de contratos futuros estão disponíveis na página Ajustes do pregão da B3

- Histórico começa em 1990

futures_get()futures_mget()

Contratos Futuros de DI1

- A curva de juros nominais é construída a partir dos contratos futuros de DI1

# A tibble: 15 × 8

refdate commodity maturity_code symbol price_previous price change

<date> <chr> <chr> <chr> <dbl> <dbl> <dbl>

1 2023-09-01 DI1 U23 DI1U23 100000 100000 0

2 2023-09-01 DI1 V23 DI1V23 99037. 99037. -0.23

3 2023-09-01 DI1 X23 DI1X23 98059. 98059. 0.26

4 2023-09-01 DI1 Z23 DI1Z23 97173. 97172. -1.28

5 2023-09-01 DI1 F24 DI1F24 96317. 96317. -0.63

6 2023-09-01 DI1 G24 DI1G24 95406. 95404. -2.48

7 2023-09-01 DI1 H24 DI1H24 94661. 94651. -9.11

8 2023-09-01 DI1 J24 DI1J24 93893. 93884. -9.53

9 2023-09-01 DI1 K24 DI1K24 93087. 93068. -19.0

10 2023-09-01 DI1 M24 DI1M24 92351. 92328. -23.2

11 2023-09-01 DI1 N24 DI1N24 91677. 91649. -28.8

12 2023-09-01 DI1 Q24 DI1Q24 90918. 90885. -33.2

13 2023-09-01 DI1 U24 DI1U24 90171. 90165. -6.36

14 2023-09-01 DI1 V24 DI1V24 89549. 89501. -48.2

15 2023-09-01 DI1 F25 DI1F25 87548. 87484. -63.9

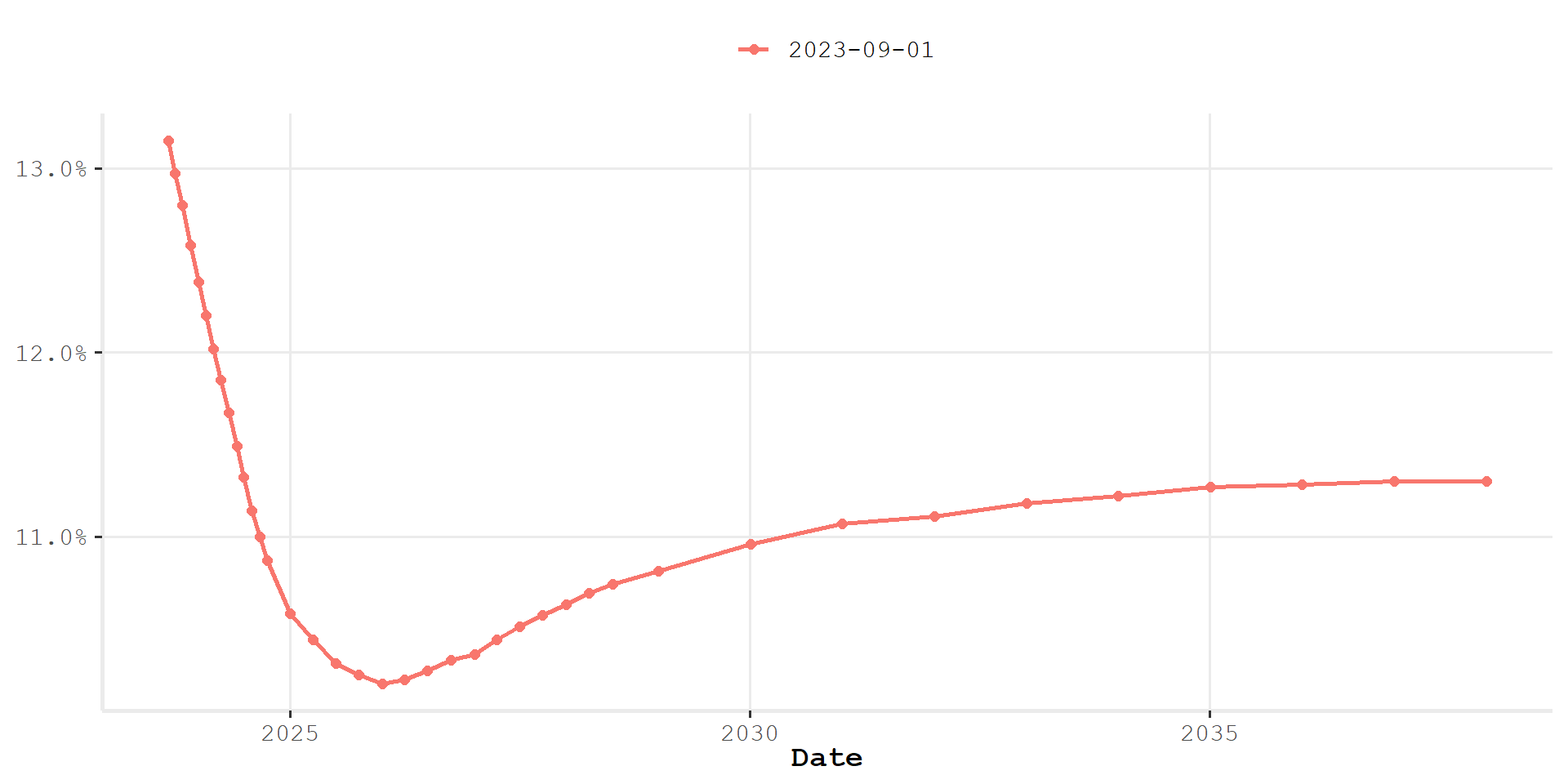

# ℹ 1 more variable: settlement_value <dbl>Contratos Futuros de DI1 + Curva de juros prefixado

- Como identificar os contratos de DI1 na curva de juros prefixados?

yc <- yc_get("2023-09-01")

fut <- futures_get("2023-09-01")

df <- yc_superset(yc, fut)

df |> head(10)# A tibble: 10 × 7

refdate cur_days biz_days forward_date r_252 r_360 symbol

<date> <int> <dbl> <date> <dbl> <dbl> <chr>

1 2023-09-01 3 1 2023-09-04 0.132 0 <NA>

2 2023-09-01 7 4 2023-09-08 0.130 0.105 <NA>

3 2023-09-01 12 7 2023-09-13 0.130 0.107 <NA>

4 2023-09-01 14 9 2023-09-15 0.130 0.119 <NA>

5 2023-09-01 20 13 2023-09-21 0.130 0.12 <NA>

6 2023-09-01 21 14 2023-09-22 0.130 0.123 <NA>

7 2023-09-01 27 18 2023-09-28 0.130 0.123 <NA>

8 2023-09-01 28 19 2023-09-29 0.130 0.126 <NA>

9 2023-09-01 31 20 2023-10-02 0.130 0.119 DI1V23

10 2023-09-01 33 22 2023-10-04 0.129 0.123 <NA> Construindo a curva de juros prefixados

Com o pacote {fixedincome} podemos construir a curva de juros prefixados a partir dos contratos futuros de DI1.

Curva de juros prefixados

Cache do 📦 {rb3}

- O sistema de cache do

{rb3}armazena todos os arquivos baixados e processados em um diretório (opçãorb3.cachedir)

- O cache pode ser utilizado como um banco de dados rudimentar.

- Todas as funções possuem os argumentos:

cache_folder = cachedir()do_cache = TRUE

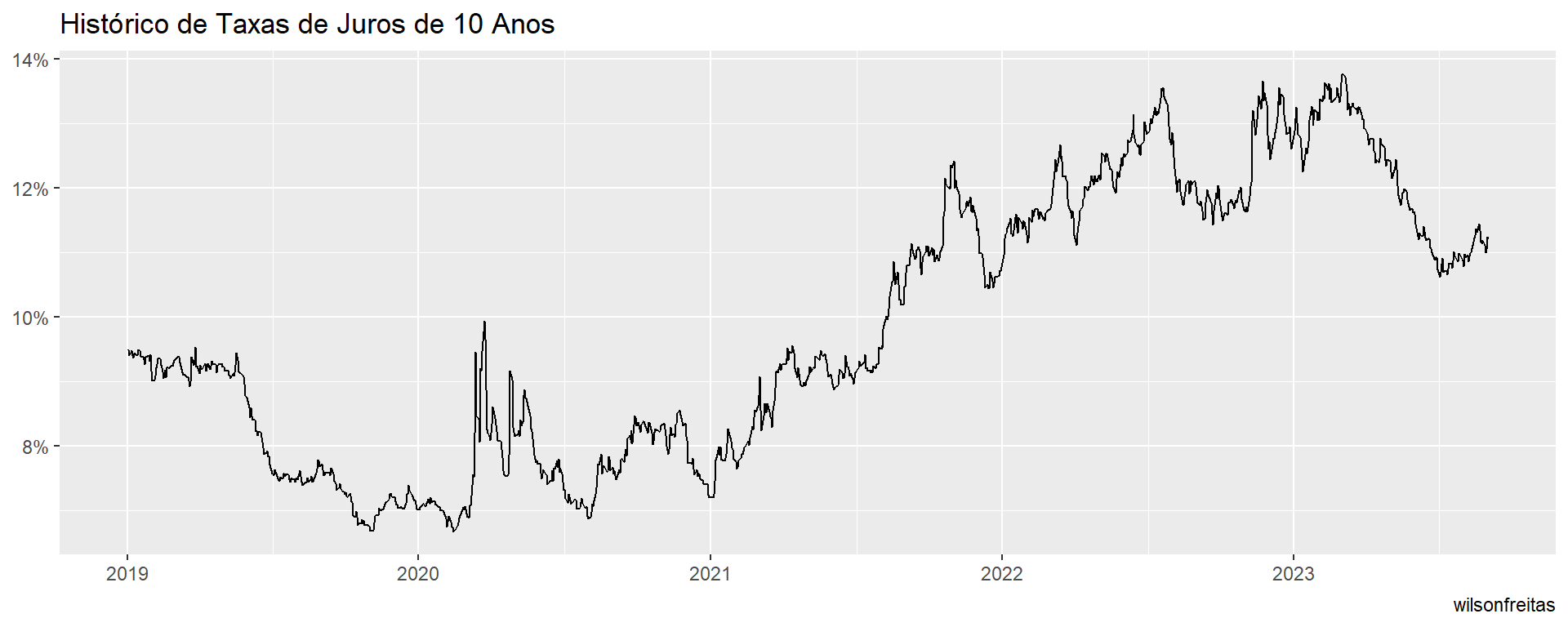

Histórico de juros prefixados de longo prazo

unique(dc$refdate) |> map(function(date, df) {

df_curve <- df |>

filter(refdate == date, biz_days > 0) |>

filter(!duplicated(biz_days))

curve <- spotratecurve(

df_curve$r_252,

df_curve$biz_days,

"discrete", "business/252", "Brazil/ANBIMA",

refdate = date

)

interpolation(curve) <- interp_flatforward()

curve

}, df = dc) -> curvesHistórico de juros prefixados de longo prazo

curves |>

map_dfr(\(x) tibble(

refdate = x@refdate,

r_BRL_10y = as.numeric(x[[2520]])

)) -> rates_10y

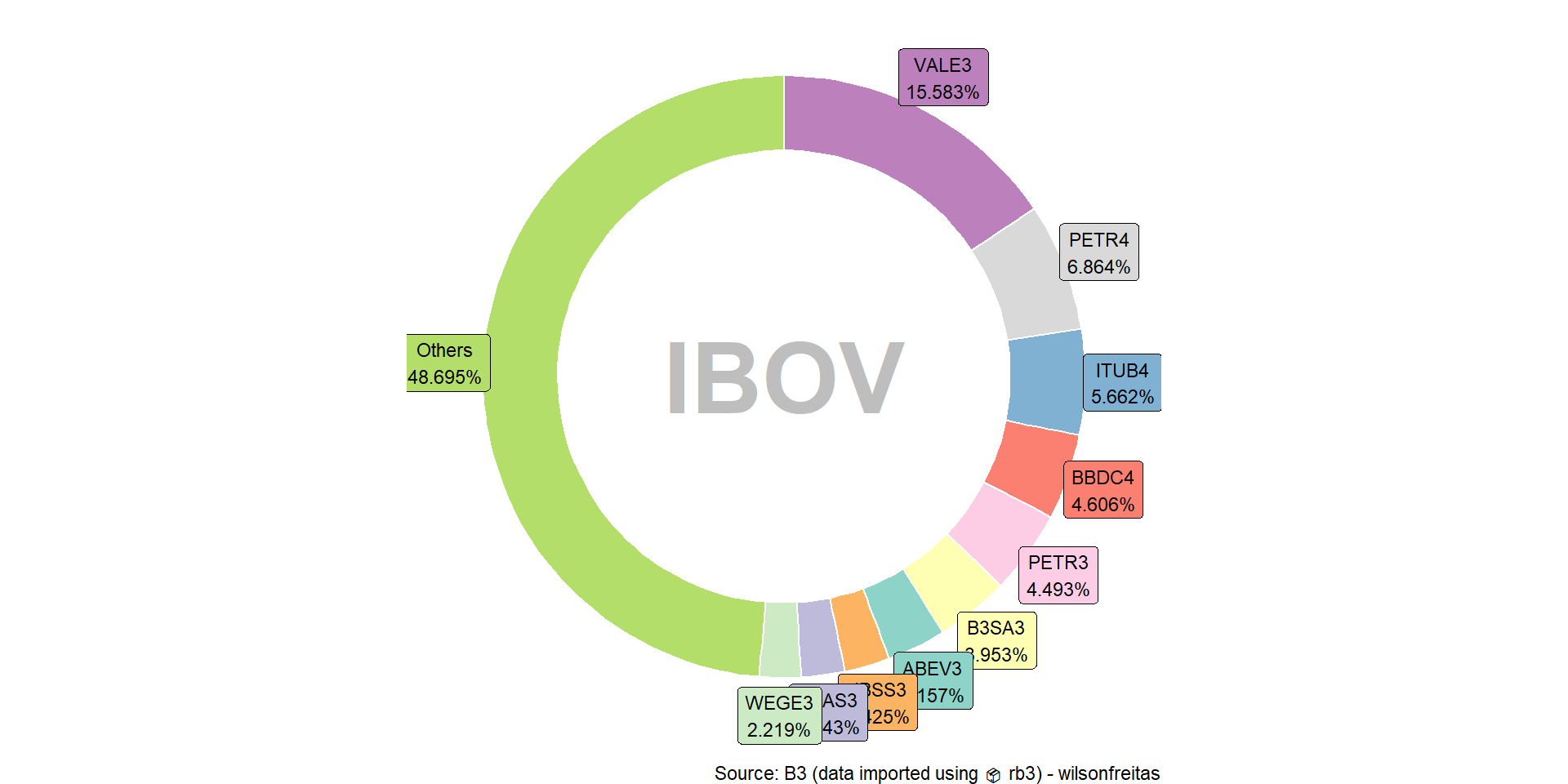

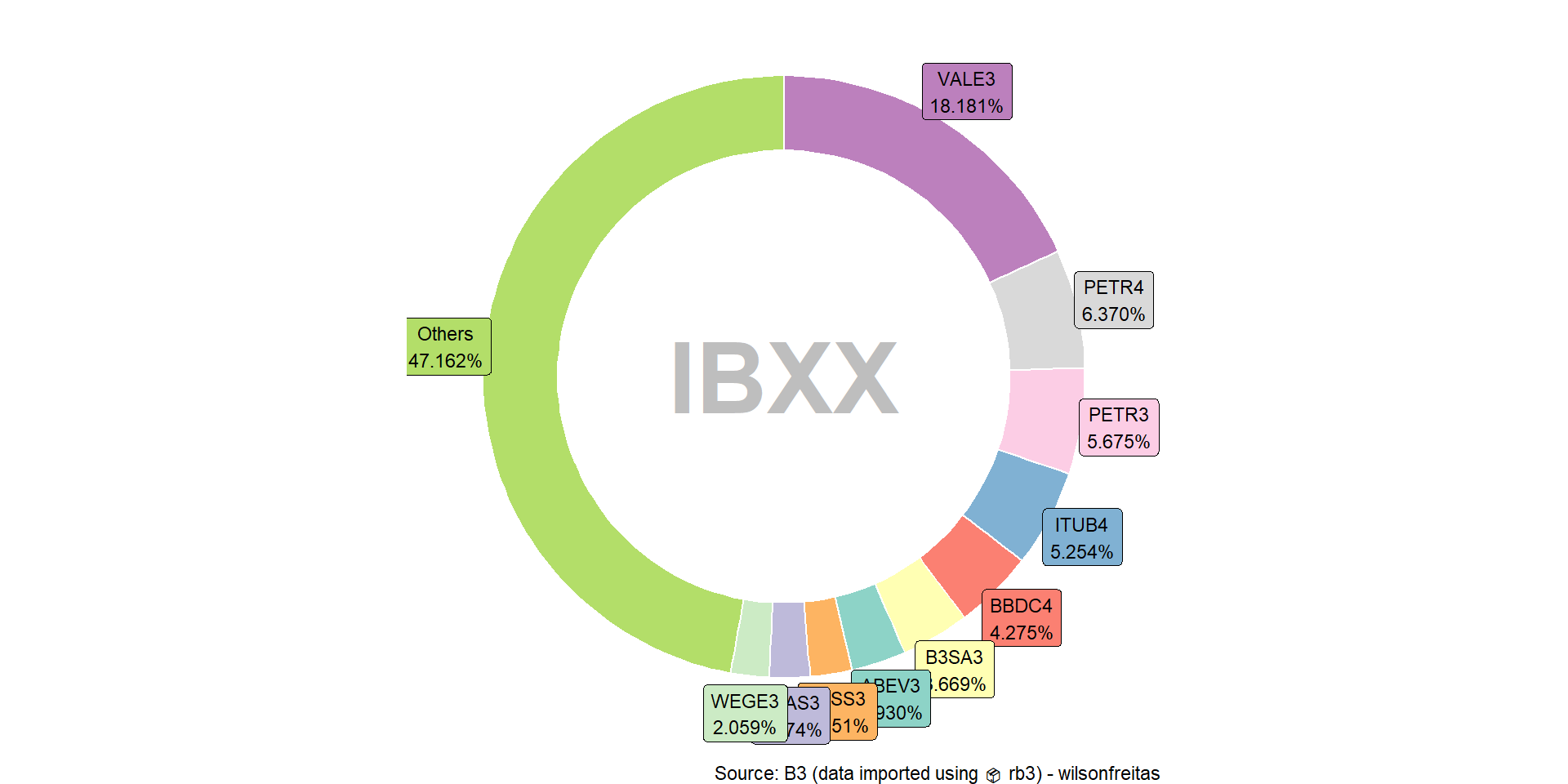

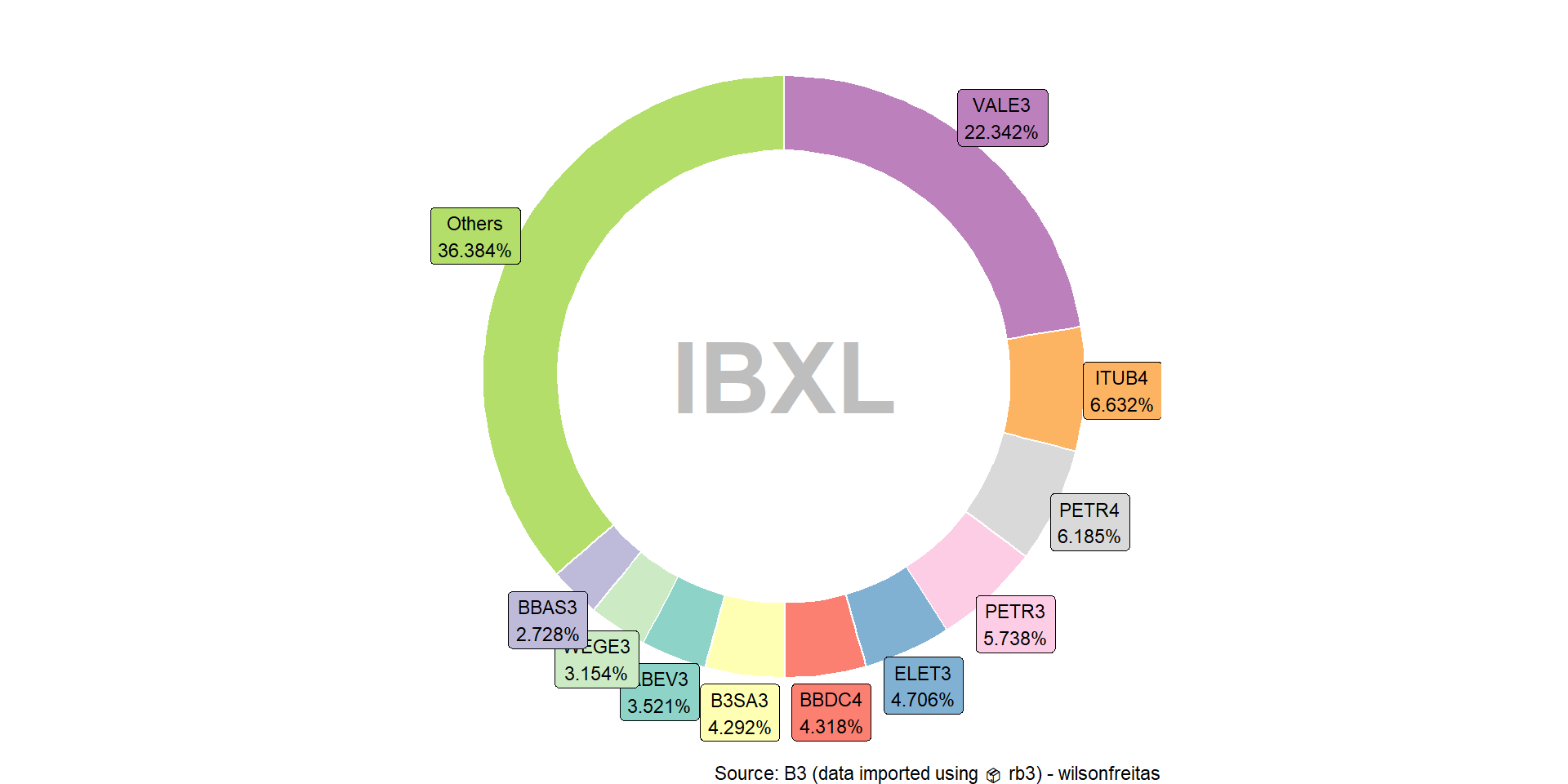

Índices da B3

- Diversas funções que retoram dados relacionados aos índides divulgados pela B3.

indexes_get(): Lista os índices disponíveisindex_get(): Séries históricas dos índicesindex_comp_get(): Composição dos índicesindex_weights_get(): Pesos dos ativos que compõem os índices

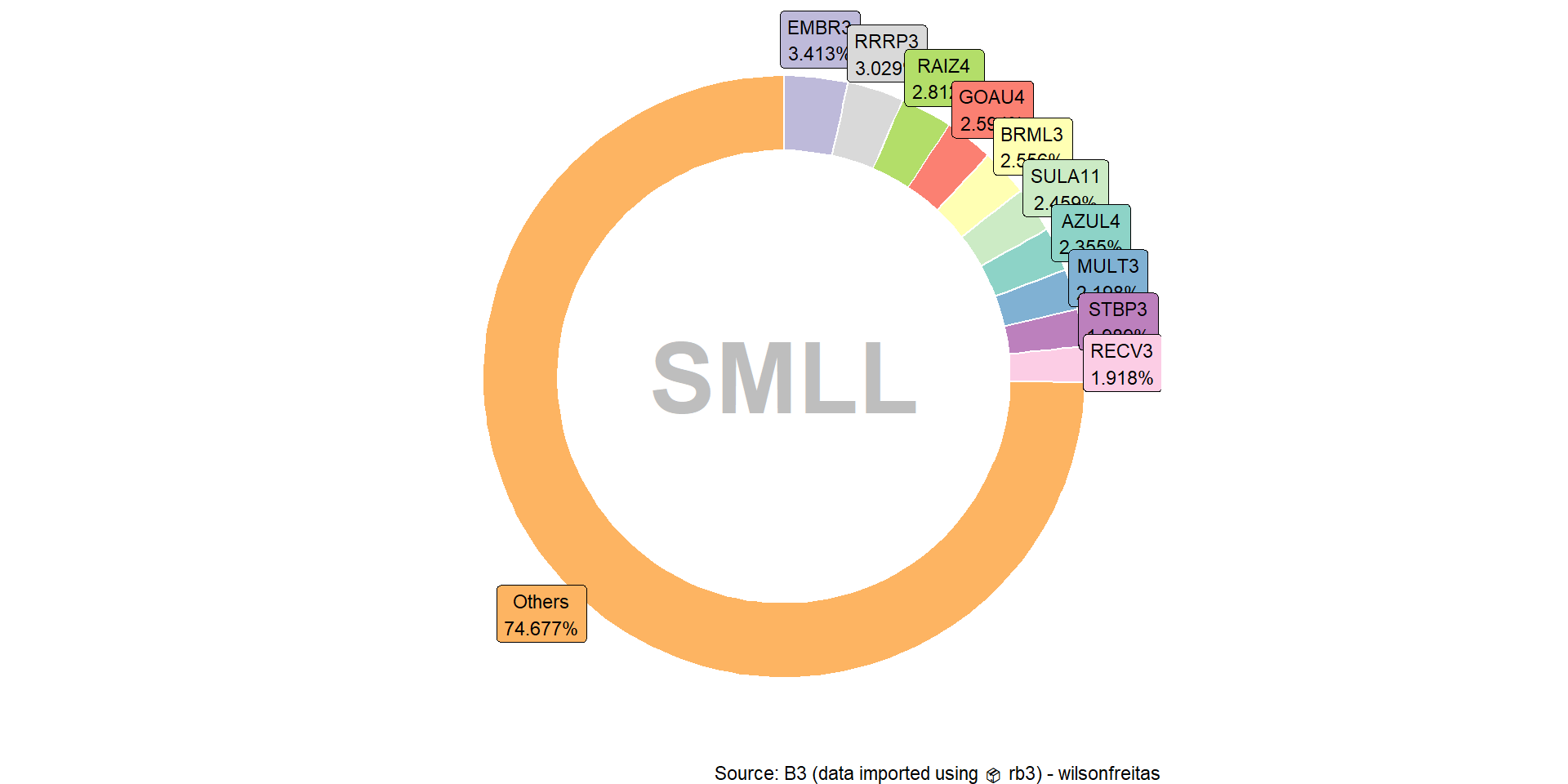

Composição de índices da B3

# A tibble: 92 × 3

symbol weight position

<chr> <dbl> <dbl>

1 ABEV3 0.0316 4380195841

2 ALPA4 0.00196 201257220

3 AMER3 0.00711 596875824

4 ASAI3 0.00603 794531367

5 AZUL4 0.00357 327741172

6 B3SA3 0.0395 5987625321

7 BBAS3 0.0234 1420530937

8 BBDC3 0.0112 1516726535

9 BBDC4 0.0461 5160570290

10 BBSE3 0.00848 671629692

# ℹ 82 more rowsComposição de índices da B3

Composição de índices da B3

Composição de índices da B3

Composição de índices da B3

Dados de ações - Arquivo COTAHIST

- Função

cotahist_get()para obter dados do arquivoCOTAHIST - Arquivos: diário, mensal e anual

- Histórico desde 1990 para arquivos anuais

cotahist_get_symbols()cotahist_equity_get()cotahist_etfs_get()cotahist_indexes_get()cotahist_equity_options_get()cotahist_index_options_get()

cotahist_funds_options_get()cotahist_bdrs_get()cotahist_units_get()cotahist_fiis_get()cotahist_fidcs_get()cotahist_fiagros_get()

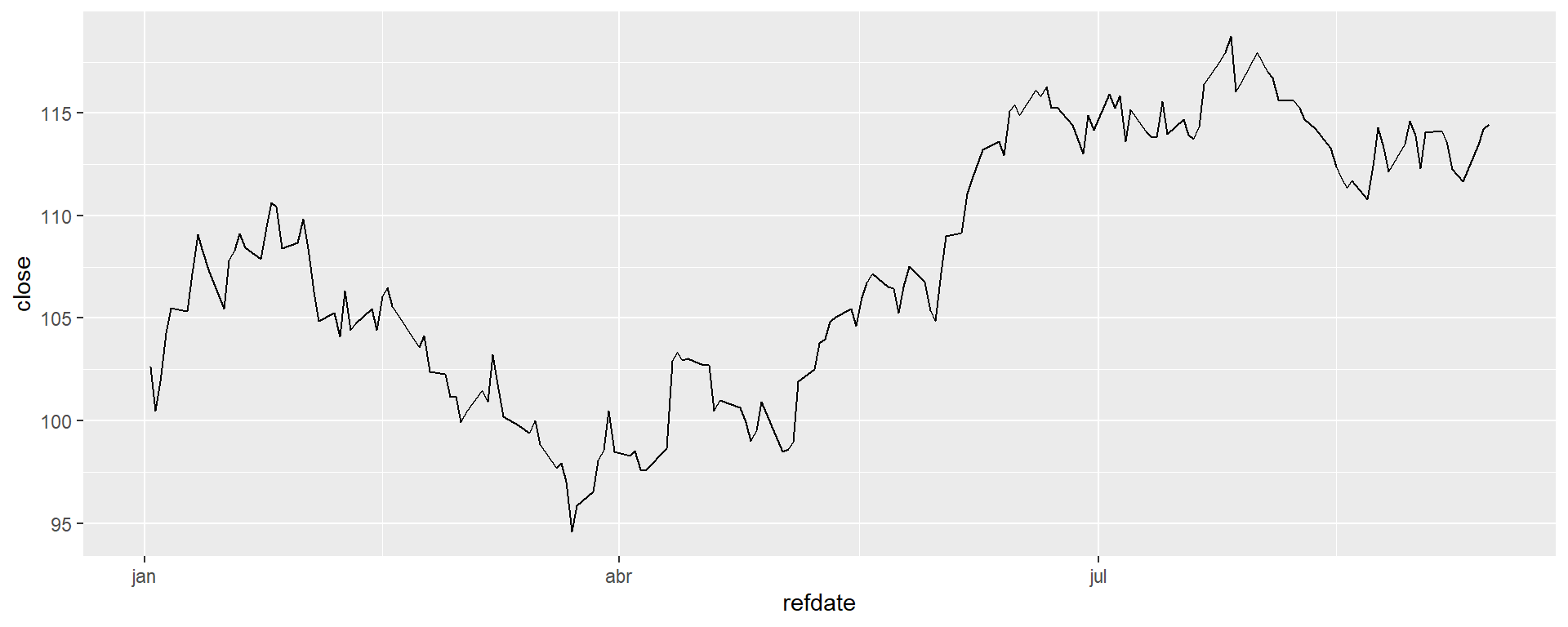

Série histórica de ETFs

Opções de ações

# A tibble: 380 × 28

refdate symbol type strike maturity_date open high low close average

<date> <chr> <fct> <dbl> <date> <dbl> <dbl> <dbl> <dbl> <dbl>

1 2023-09-01 PETRI4… Call 14.7 2023-09-15 17.8 17.8 17.8 17.8 17.8

2 2023-09-01 PETRI2… Call 0.34 2023-09-15 32 32 32 32 32

3 2023-09-01 PETRL1 Call 12.8 2023-12-15 20 20 20 20 20

4 2023-09-01 PETRL5… Call 27.8 2023-12-15 6 6 5.8 5.8 5.8

5 2023-09-01 PETRL5… Call 28.8 2023-12-15 4.9 5.2 4.9 5.18 5.18

6 2023-09-01 PETRL5… Call 29.8 2023-12-15 4.3 4.5 4.26 4.5 4.33

7 2023-09-01 PETRX1 Put 12.8 2023-12-15 0.01 0.01 0.01 0.01 0.01

8 2023-09-01 PETRX2… Put 3.79 2023-12-15 0.01 0.01 0.01 0.01 0.01

9 2023-09-01 PETRX4… Put 23.8 2023-12-15 0.2 0.2 0.2 0.2 0.2

10 2023-09-01 PETRX4… Put 25.8 2023-12-15 0.29 0.29 0.29 0.29 0.29

# ℹ 370 more rows

# ℹ 18 more variables: volume <dbl>, traded_contracts <dbl>,

# transactions_quantity <int>, distribution_id <int>,

# symbol.underlying <chr>, open.underlying <dbl>, high.underlying <dbl>,

# low.underlying <dbl>, close.underlying <dbl>, average.underlying <dbl>,

# best_bid <dbl>, best_ask <dbl>, volume.underlying <dbl>,

# traded_contracts.underlying <dbl>, …Opções de ações

library(bizdays)

library(oplib)

maturities <- unique(op1$maturity_date) |> sort()

close_underlying <- op1$close.underlying[1]

op_vol <- op1 |>

filter(maturity_date %in% maturities[1:2]) |>

mutate(

biz_days = bizdays(

refdate, following(maturity_date, "Brazil/ANBIMA"), "Brazil/ANBIMA"

),

time_to_maturity = biz_days / 252,

rate = log(1 + r_252),

impvol = bsmimpvol(

close, type, close.underlying, strike, time_to_maturity, rate, 0

),

delta = bsmdelta(

type, close.underlying, strike, time_to_maturity, rate, 0, impvol

)

) |>

select(

symbol, volume,

type, close.underlying, strike, time_to_maturity, rate, impvol,

delta, biz_days, volume

)Opções de ações

# A tibble: 334 × 10

symbol volume type close.underlying strike time_to_maturity rate impvol delta biz_days

<chr> <dbl> <fct> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 PETRI400 5331 Call 32.6 14.7 0.0357 0.122 NA NA 9

2 PETRI200 6400 Call 32.6 0.34 0.0357 0.122 NA NA 9

3 PETRJ237 699536 Call 32.6 14.8 0.131 0.121 NA NA 33

4 PETRI281 275641 Call 32.6 22.4 0.0357 0.122 1.03 0.979 9

5 PETRJ245 15235 Call 32.6 18.8 0.131 0.121 NA NA 33

6 PETRJ250 305844 Call 32.6 19.3 0.131 0.121 NA NA 33

7 PETRJ260 31770 Call 32.6 20.3 0.131 0.121 NA NA 33

8 PETRJ265 50406 Call 32.6 20.8 0.131 0.121 NA NA 33

9 PETRJ240 129715 Call 32.6 18.3 0.131 0.121 NA NA 33

10 PETRI254 1282 Call 32.6 19.7 0.0357 0.122 NA NA 9

# ℹ 324 more rowsVolatilidade implícita

Dinâmica da Volatilidade implícita

Dinâmica da Volatilidade implícita

op_vol <- op |>

mutate(

biz_days = bizdays(

refdate, following(maturity_date, "Brazil/B3"), "Brazil/B3"

),

time_to_maturity = biz_days / 252,

rate = log(1 + r_252),

bsm_impvol = bsmimpvol(

close, type, close.underlying, strike, time_to_maturity, rate, 0

),

delta = bsmdelta(

type, close.underlying, strike, time_to_maturity, rate, 0, bsm_impvol

)

) |>

select(

refdate, symbol, volume, maturity_date,

type, close.underlying, strike, time_to_maturity, rate,

biz_days, close, high, low, bsm_impvol, delta

)Dinâmica da Volatilidade implícita

op1 <- op_vol |>

split(op_vol$refdate) |>

map_dfr(function(df) {

first_mat <- df$maturity_date[which.min(df$maturity_date)]

filter(df, maturity_date == first_mat)

})Dinâmica da Volatilidade implícita

- https://github.com/wilsonfreitas/rb3-ufrgs-2023

- http://wilsonfreitas.github.io/rb3

- http://wilsonfreitas.github.io/R-fixedincome

- http://wilsonfreitas.github.io/R-bizdays

- https://github.com/wilsonfreitas/oplib

Wilson Freitas